The University of Bristol’s Personal Finance Research Centre (PFRC) is today pleased to announce the launch of Money and Gambling: Practice, Insight, Evidence (MAGPIE), a new three-year strategic programme, in partnership with Gamble Aware, which looks at the role that financial services organisations can play in reducing gambling-related harm.

Gambling problems can destroy lives, often leaving those affected to live with severe financial and social consequences. Indeed, around seven in ten people seeking help for gambling problems report that they are in debt, with a third of these owing £10,000 or more. Between 2007 and 2014 there were an average of 500 bankruptcies per year known to be linked to gambling – the true figure, however, may be much higher because people may not disclose that their bankruptcy is related to gambling.[1]

While many people do enjoy gambling safely, the number of people who are ‘problem gamblers’ or who suffer negative consequences as a result of their gambling is far from insignificant. It is estimated that in 2016 nearly a million adults in Britain experienced sizeable negative consequences as a result of their gambling, with around 360,000 adults classified as ‘problem gamblers’ (Gambling Commission, 2019).

Betting on the banks?

Money and gambling are clearly intricately linked, with ‘gambling more than you can afford’ one of the key indicators of a gambling problem. As such, it makes sense that organisations that help us look after our money – the world of ‘financial services’ – might also be able to take actions to help those at-risk of gambling-related harm.

Such firms are regulated by the Financial Conduct Authority (FCA), which in recent years has upped its focus on the way that companies treat customers in vulnerable situations – including those living with gambling problems. As a result, firms are paying increased attention to the way that they identify and support such customers.

Indeed, in 2016, PFRC conducted research with over 1,500 frontline debt collection staff working in a wide range of financial services firms, including high-street banks, lenders and debt collection agencies. This research focused on staff members’ experiences of working with customers in vulnerable situations, including those with mental health problems, suicidal thoughts and addictions, and highlighted some of the challenges that they face – whether in identifying ‘vulnerability’, starting a conversation about it, or providing customers with adequate support or sign-posting to other sources of support.

Following that research, we held a number of ‘problem-solving workshops’ with firms, charities and those with lived experience of different vulnerable situations to develop new tools and guidance for debt collection staff when working with such customers. Many of the solutions developed have now been adopted (or, in some cases, even adapted) by firms – highlighting the fact that there is considerable appetite among those working in financial services to do what they can to help such customers.

When the funds stop, stop?

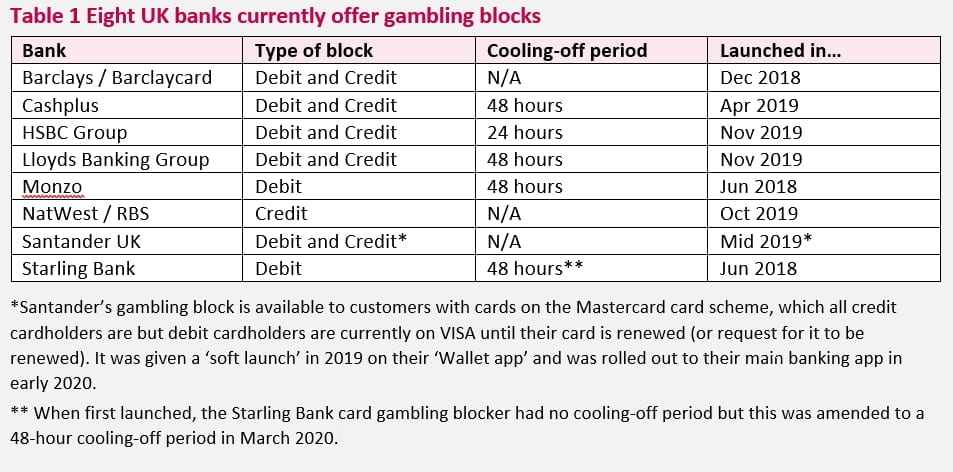

Last year saw the introduction of spending controls or ‘gambling blocks’ by several UK banks – most notably Barclays, Monzo and Starling. Once turned on by customers, these essentially prevent spending on a bank card at gambling outlets (both online or in-person).

We know that people in recovery from problem gambling already use informal workarounds to prevent themselves from spending money on gambling, such as forfeiting their card to a third party or scratching off the card security number. The new solutions from banks, however, allow customers to do this more formally – and, possibly, more successfully.

But at present there is limited evidence about the effectiveness of such spending controls, nor about the characteristics of those who use them. We also don’t know much about the unintended consequences of these spending blockers (for example, whether it leads to customers withdrawing more money as cash and gambling with that).

As such, the first six months of our programme will focus on answering these questions and building the evidence-base around what works for recovering gamblers. We will use this evidence to produce practical guidance for financial services firms around the design of spending blockers.

Get involved in the research

In order to build the evidence-base, we’ll be working closely throughout the project with financial services firms – but, more importantly, our research will place those with lived experience of problem gambling at the centre of the project, as well as those with expertise in the treatment of recovering gamblers.

So, if you’re interested in being part of the research or if you simply want to be kept updated, you can join our money and gambling network by filling out this short form.

Notes:

GambleAware is an independent charity that champions a public health approach to preventing gambling harms. The charity is a commissioner of integrated prevention, education and treatment services on a national scale, with over £40 million of grant funding under active management. In partnership with gambling treatment providers, GambleAware has spent several years methodically building structures for commissioning a coherent system of brief intervention and treatment services, with clearly defined care pathways and established referral routes to and from the NHS – a National Gambling Treatment Service. Follow GambleAware on Twitter: @GambleAware

GambleAware also runs the website BeGambleAware.org which helps 4.2 million visitors a year and signposts to a wide range of support services. Follow BeGambleAware on Twitter: @BeGambleAware

[1] See RGSB (2015) Understanding gambling-related harm and debt. Available at: https://www.rgsb.org.uk/PDF/Understanding-gambling-related-harm-and-debt-July-2015.pdf