By Sharon Collard, Jamie Evans and Chris Fitch

Our review of bank card gambling blockers published today shows they can be an effective way to help people control their spending on gambling. To make sure more people can benefit from this technology, all banks and credit card firms should offer blockers as a standard feature on their cards, with a time-released lock of at least 48 hours and the option to limit cash withdrawals.

A lot has happened since September 2019 when we officially launched the ‘Money and Gambling: Practice, Insight, Evidence (MAGPIE)’ programme funded by GambleAware. With the COVID-19 crisis ongoing, there are concerns that regular online gamblers have gambled more during lockdown; while both the House of Commons and the House of Lords have called for urgent reform of gambling regulation so that children, young people and adults are properly protected from gambling harm.

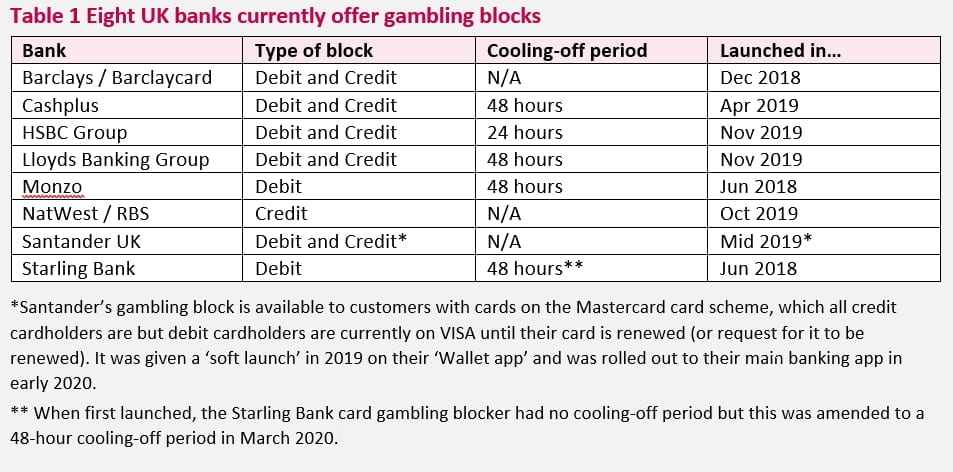

Our review of bank card gambling blockers shows they can help people control their gambling spend but they need to be much more widely available. While eight UK financial firms offer gambling blocks as standard to customers with a credit or debit card (see Table 1 below), as many as 28 million personal current accounts and 35 million credit cards may not have this option. We believe that blockers should be a standard feature available to all card holders across a firm’s full card range.

There is also work to be done to make sure people know about bank card gambling blocks. Nearly half of our survey participants (43%) – many of whom were receiving treatment and support for their gambling – were not aware that bank gambling blocks exist.

The design of bank card blockers is critical to their effectiveness. Some can be toggled on and off by customers at will – making them a light switch rather than a lock. Our review shows that a time-released lock of at least 48 hours should be a standard feature on all blockers – something the House of Lords also supports. To complement gambling blockers on cards, we want to see customers given the option to limit their ATM withdrawals. A ‘third line of defence’ could be the option to block cash transfers from a credit card to an account where the money could be used to gamble.

Despite the Gambling Commission’s recent ban on licensed gambling companies accepting credit card payments, we believe that every credit card should still offer gambling blocks. This is because online gambling sites outside of Britain are not licensed by the Gambling Commission and continue to allow customers in England, Wales and Scotland to gamble via credit card payments. Credit card providers could go one step further by automatically restricting gambling on all credit cards, rather than relying on customers to turn on a block. Even then, there remains a risk that unscrupulous gambling operators engage in ‘transaction laundering’ which renders a gambling block ineffective.

Gambling blocks can help but they are not enough. People with experience of gambling harms want to see financial firms take wider action if they are serious about helping tackle this public health issue. Beyond banks, they want the gambling industry, regulators and the Government to do much more to protect consumers in a world of boundless and frictionless gambling where, in the words of one participant, it is possible to go from “zero to devastation in a very short period”.

Read the report:

A Blueprint for Bank Card Gambling Blockers – Report | A Blueprint for Bank Card Gambling Blockers – Executive Summary