By Jamie Evans and Sharon Collard

Yesterday’s move by the Gambling Commission to ban gambling using credit cards is a welcome public health intervention and one that now shifts the focus onto other ways for people to control their gambling spend. ‘Spending controls’, offered by a growing number of banks, provide one such solution, giving customers the option to block gambling transactions from their accounts. But how can banks maximise the effectiveness of such controls? In this blog, we provide an update from our strategic partnership with GambleAware, which aims to answer this and other questions about the potential role of financial services firms in reducing gambling-related harm.

In September 2019, we officially launched ‘Money and Gambling: Practice, Insight, Evidence (MAGPIE)’ – a three-year programme between the University of Bristol’s Personal Finance Research Centre (PFRC) and GambleAware, a charity who fund research, prevention and treatment into the harms of gambling. The programme is designed to explore and improve the way that financial firms tackle gambling-related harm.

Since then, we have been busy working on the first of several projects within the programme. This considers how ‘spending controls’ – otherwise known as ‘gambling blocks’ – that are available on a growing number of debit and credit cards can be as effective as possible in reducing gambling-related harm. To do this, we have conducted expert interviews with banks and other key stakeholders; consulted people affected by gambling through Advisory Boards and interviews; and reviewed academic and other literature on this topic.

We are also working with banks that have launched spending controls to understand patterns in customer data and are running an online survey of people affected by gambling to find out more about their views and experiences of spending controls. Collectively, we hope the new data collected from these different sources will help improve the industry’s understanding of what does and doesn’t work when it comes to spending controls.

So what spending controls currently exist?

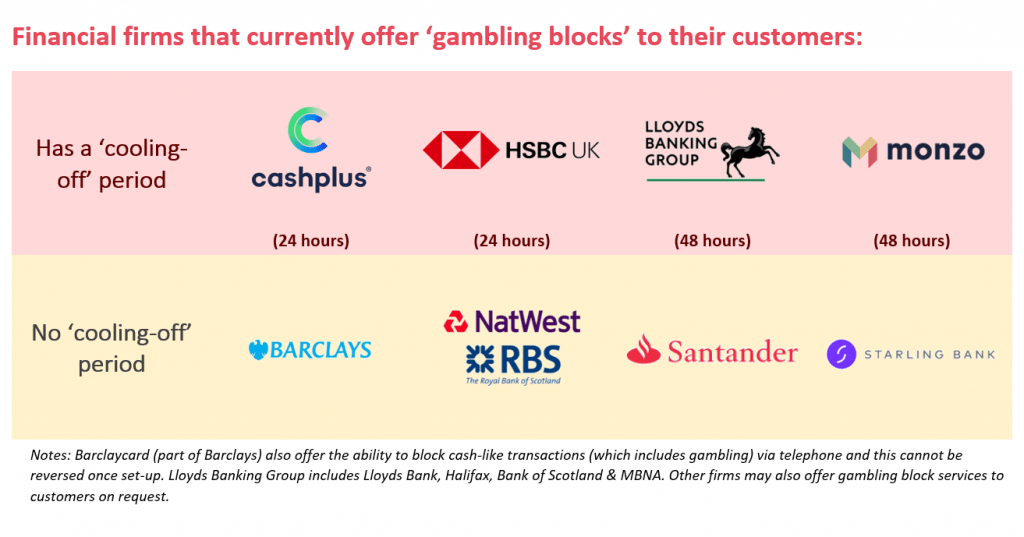

Customers of several UK financial services firms now have access to gambling blocks on their accounts (as shown in the below diagram) – and we know of at least one other firm that offers a similar service on request if you telephone them. Blocks on credit card transactions should, in theory, be unnecessary once the wider ban on gambling with credit cards is introduced in April 2020.

The diagram shows that gambling blocks differ in terms of their ‘cooling off’ period (i.e. the length of time after choosing to turn off a gambling block that someone would have to wait until they can gamble again on their account). Some currently offer no cooling-off period, which means that a customer could use the card to gamble as soon as they turn off the block. CashPlus and HSBC both have a 24 hour cooling off period; while Lloyds Banking Group (including Lloyds Bank, Halifax, Bank of Scotland and MBNA) and Monzo require customers to wait 48 hours before they can gamble again.

This cooling-off period is generally recognised, by banks and treatment providers, as a crucial component of an effective gambling block – especially for customers engaged in more high-risk gambling behaviours. As such, we are very likely to see more firms incorporating this kind of ‘friction’ into their spending controls in the near future.

More than the ‘cooling-off’ period…

While obviously important, our work recognises that an effective gambling block is about more than just its cooling-off period. Friction can come in many forms and there are some really interesting ideas on the horizon about the shape that these could take.

There are also a range of other fascinating, albeit challenging, questions that we need to answer. For example, we need to understand more about the customer’s engagement with staff if and when they try to turn off the block, or what happens if they try to gamble when the block is turned on. How are gambling blocks being communicated to customers, and how do financial services firms reach the right people? Who even are the ‘right people’?! It might be the case that a whole spectrum of products and services should be made available to customers engaging in a wide range of gambling behaviours, including those who might not be engaged in risky gambling behaviours right now but may do so in future.

And there are questions that may stretch beyond the usual remit of the financial services sector. How, for example, might unscrupulous gambling operators try to circumvent such spending controls, and – crucially – what can we do about this?

Lessons from the literature

There exists a rich body of academic literature about gambling and ways to reduce gambling-related harm. To bring this literature to a wider audience – including financial services firms – we have published a Roadmap which sets out the rationale for our programme and summarises some of the existing evidence that is relevant to spending controls. It highlights, for example, the importance of viewing spending controls as one tool in a wider harm minimisation toolkit, as well as the importance of considering the other people affected by gambling (such as partners, families, friends) and the help and support they might require from financial services firms.

You can read this roadmap document here and sign-up for updates about the programme here.